Why an Education Loan EMI Calculator Matters for Students

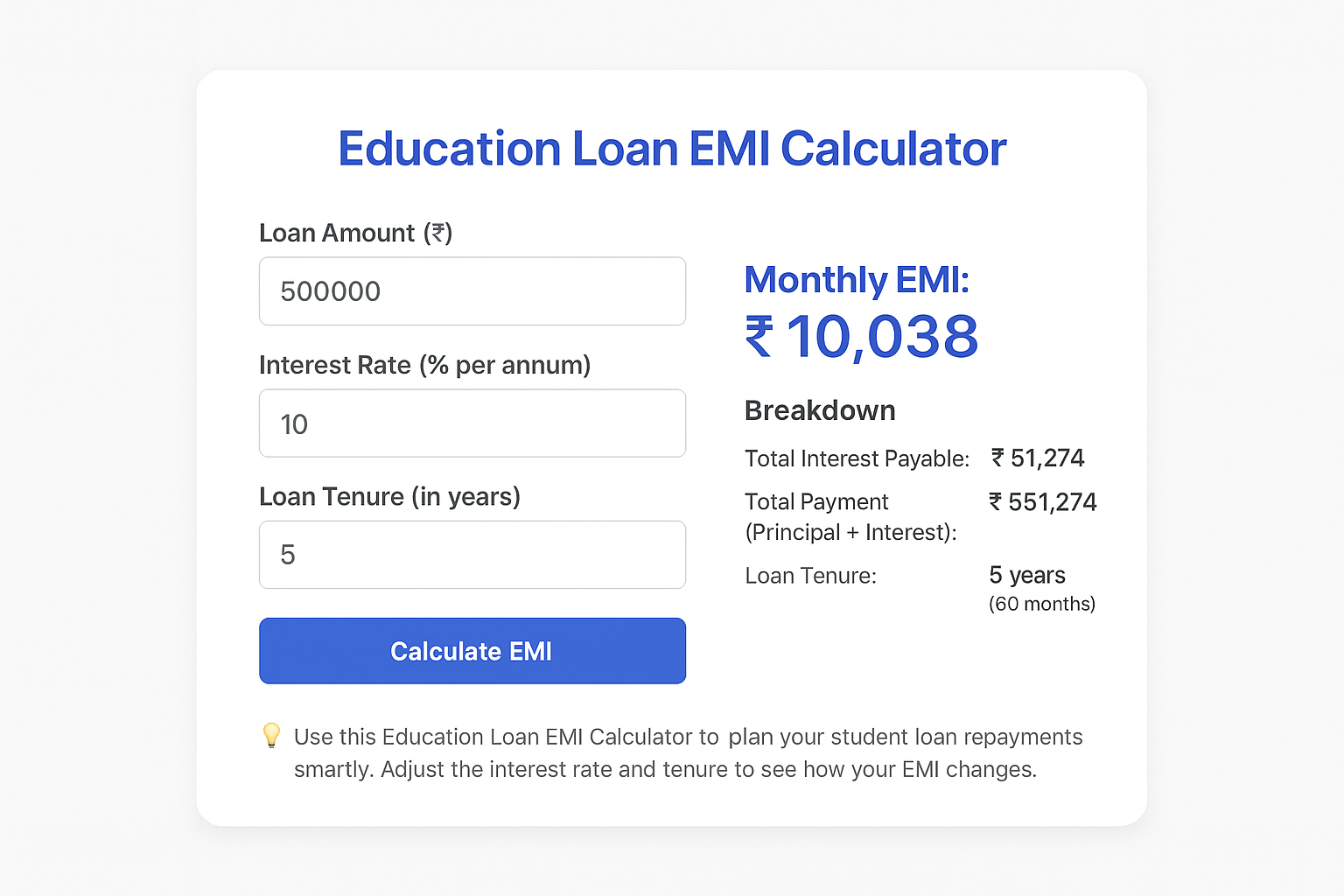

Education Loan EMI Calculator

💡 Use this Education Loan EMI Calculator to plan your student loan repayments smartly. Adjust the interest rate and tenure to see how your EMI changes.

Pursuing higher education is one of the most rewarding investments in life — but it often comes with significant financial commitments. Whether you’re studying in India or abroad, understanding your loan repayment structure is essential before borrowing.

That’s where an Education Loan EMI Calculator becomes your most powerful financial tool. It helps you plan your education loan, understand how much you’ll pay each month (EMI), and avoid surprises later.

This guide will explain everything about an education loan EMI calculator, how it works, the formula behind it, and why every student should use it before applying for a loan.

What Is an Education Loan EMI Calculator?

An education loan EMI calculator is an online tool designed to calculate the Equated Monthly Installment (EMI) you’ll need to pay for your education loan.

It helps you understand three major components:

- Principal Amount – The total loan amount you borrow.

- Interest Rate – The rate charged by the lender on your loan.

- Loan Tenure – The period over which you’ll repay your loan.

By entering these three values, the education loan EMI calculator instantly shows your monthly EMI, total interest payable, and total repayment amount — saving you hours of manual calculations.

How Does an Education Loan EMI Calculator Work?

The education loan EMI calculator uses a simple mathematical formula based on compound interest.

Here’s the formula it follows: EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N−1P×R×(1+R)N

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate divided by 12 and by 100)

- N = Loan tenure in months

Example:

Suppose you take an education loan of ₹10,00,000 at 10% interest for 10 years (120 months).

Then:

R = 10 / 12 / 100 = 0.00833

N = 120

P = 10,00,000

Plug these into the formula:

EMI = ₹13,215 approx.

This means your monthly repayment will be ₹13,215, and over 10 years, you’ll repay about ₹15.86 lakh, including interest.

An education loan EMI calculator performs these calculations instantly, ensuring accuracy and saving you from manual effort.

Benefits of Using an Education Loan EMI Calculator

Using an education loan EMI calculator gives you a clear picture of your future financial obligations before you borrow. Let’s look at its top benefits:

1. Accurate Financial Planning

The calculator shows you the exact EMI, total interest, and total repayment amount, helping you make informed financial decisions.

2. Saves Time

Instead of manually calculating complex formulas, you get instant results with just one click.

3. Compare Multiple Loan Offers

You can quickly compare different lenders by adjusting the interest rate and tenure in the calculator — making it easy to find the most affordable loan option.

4. Plan for Prepayments

You can test how much EMI reduces if you make a partial prepayment or choose a shorter tenure.

5. Transparency and Confidence

An education loan EMI calculator removes guesswork. You know exactly what to expect before signing your loan agreement.

Components of an Education Loan EMI Calculator

A high-quality education loan EMI calculator typically includes:

- Loan Amount Slider or Input Box – to enter the total amount you need.

- Interest Rate Box – to specify the annual rate offered by your bank.

- Loan Tenure Selector – to choose your repayment duration (in months or years).

- Calculate Button – that instantly generates EMI, total interest, and repayment schedule.

- Amortization Chart – a detailed breakdown showing monthly payments, interest vs. principal, and outstanding balance.

Why Every Student Should Use an Education Loan EMI Calculator Before Borrowing

Taking a student loan is a long-term financial responsibility. Before signing any loan agreement, students and parents should understand how much they’ll need to repay monthly.

Here’s why using an education loan EMI calculator is essential:

- 💡 It prevents over-borrowing — you’ll know how much EMI you can realistically afford.

- 📅 It helps you choose the right tenure to balance EMI and total interest.

- 💸 It gives you a realistic repayment plan after graduation.

- 📈 It allows you to explore different interest rate options and find the lowest-cost lender.

How to Use an Education Loan EMI Calculator Step-by-Step

Using the calculator is easy and takes less than a minute. Here’s how:

- Visit an online education loan EMI calculator (many banks and education portals provide free tools).

- Enter Loan Amount – the total sum you plan to borrow.

- Enter Interest Rate – the annual percentage offered by your chosen lender.

- Enter Tenure – the total repayment duration (e.g., 5, 7, 10 years).

- Click Calculate.

The calculator will instantly show:

- Your monthly EMI

- Your total repayment amount

- Your total interest outgo

This gives you full control and clarity before taking any financial decision.

Factors That Affect Your Education Loan EMI

The EMI amount is influenced by several factors. Understanding these can help you manage your loan better:

1. Loan Amount: Higher the loan amount, higher the EMI.

2. Interest Rate: Even a small difference in interest rate (e.g., 0.5%) can significantly impact total repayment.

3. Loan Tenure: Longer tenure reduces monthly EMI but increases total interest.

4. Moratorium Period: Some lenders allow students to start EMI payments after completing their course. During this period, interest may still accrue.

5. Prepayment or Part Payment: Paying part of your loan early can reduce both EMI and total interest burden.

Compare Education Loan Offers Using an EMI Calculator

Different banks and NBFCs offer varying rates for education loans. By using an education loan EMI calculator, you can compare offers from institutions like:

- State Bank of India (SBI)

- HDFC Credila

- Axis Bank

- ICICI Bank

- Bank of Baroda

- IDFC First Bank

You can enter the same loan amount with different interest rates in the calculator and instantly see which option is more affordable.

Tips to Reduce Your Education Loan EMI Burden

- Opt for a Longer Tenure:

Extending tenure can lower your monthly EMI, though you’ll pay more interest overall. - Make Prepayments:

Whenever possible, make lump-sum payments to reduce the outstanding balance. - Choose a Lower Interest Rate:

Compare rates from multiple lenders — even a small reduction can save thousands. - Apply for Government Subsidy Schemes:

Schemes like the Central Sector Interest Subsidy (CSIS) help students from economically weaker sections by subsidizing interest during the study period. - Use a Reliable Education Loan EMI Calculator:

Plan before you borrow — it helps avoid future financial stress.

Advantages of Using an Online Education Loan EMI Calculator Over Manual Calculation

| Feature | Online Calculator | Manual Calculation |

|---|---|---|

| Accuracy | 100% accurate | Prone to errors |

| Speed | Instant | Time-consuming |

| Comparisons | Easy to compare offers | Difficult manually |

| Visual Chart | Shows amortization graph | Not possible |

| Flexibility | Change values anytime | Needs re-calculation |

Clearly, an education loan EMI calculator is far more efficient and reliable.

Why Use an Education Loan EMI Calculator on Our Website?

Our education loan EMI calculator is built to be fast, free, and user-friendly. You can:

- Calculate EMI in seconds

- Compare multiple loan scenarios

- Plan repayment effectively

- Access real-time EMI breakdowns

It’s optimized for students, parents, and professionals planning higher education in India or abroad.

👉 Try our Education Loan EMI Calculator today and make confident financial decisions for your academic future.

Frequently Asked Questions (FAQs)

1. What is the benefit of using an education loan EMI calculator?

It helps you know your monthly EMI, total interest payable, and overall loan repayment amount — allowing better budgeting and planning.

2. Is the EMI calculator free to use?

Yes! Most online calculators are completely free and provide instant results.

3. Does the calculator include moratorium periods?

Some advanced calculators allow you to include the moratorium (grace) period in the calculation for accurate results.

4. Can I calculate EMI for international education loans?

Yes, an education loan EMI calculator works for both domestic and international study loans — simply enter the correct loan amount and interest rate.

5. Do banks use the same formula as online calculators?

Yes. Online calculators use the same standard EMI formula used by banks and financial institutions.

Conclusion: Plan Smartly with the Education Loan EMI Calculator

Education is an investment that shapes your career and future. But like any investment, it must be planned wisely.

Before applying for a loan, use a reliable education loan EMI calculator to understand your repayment structure, interest outgo, and monthly burden.

It’s not just a calculator — it’s your personal financial advisor, helping you make smart, stress-free decisions about funding your education.

So, before signing your loan agreement, take a minute to explore your numbers. Try the Education Loan EMI Calculator on our website and make your dream of quality education financially achievable.